parker county tax assessment

Search Any Address 2. Ad Find Out the Market Value of Any Property and Past Sale Prices.

Do My Property Taxes Increase If I Put A Cheap Mobile Home Or Rv On My Houston Texas Land Quora

Jenny Gentry Physical Address.

. Box 2740 Weatherford TX 76086-8740 Telephone. TAX RATE INFORMATION. Discover Parker County Tax Assessor for getting more useful information about real estate apartment mortgages near you.

817 598-6133 Email Address. The Parker County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Parker County and may. Certain Tax Records are considered public record which means they are available to the public while some Tax.

The median property tax in Parker County Texas is 2461 per year for a home worth the median value of 147100. Get driving directions to this office. The Parker County Assessors Office located in Weatherford Texas determines the value of all taxable property in Parker County TX.

Parker County proclaims March 6 2022 as Black Balloon Day. This County Tax Office works in partnership with our Vehicle Titles and Registration Division. Parker County has one of the highest median property taxes in the United States and is ranked 287th of the 3143 counties in order of median property taxes.

1108 Santa Fe Dr Weatherford Texas 76086. Parker County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. A sample of the Notice of Assessment of Land and Structures - Form 11 and a letter to Parke County Taxpayers regarding the Form 11 may be viewed by selecting Notices on the menu bar then selecting Assessor.

Tax Records include property tax assessments property appraisals and income tax records. Registration Renewals License Plates and Registration Stickers. Parker County Appraisal District.

Parker Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Parker Colorado. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office. Property Taxes Tickets etc.

Parker County Tax Office. Jobs At The White House Washington Dc Cvs 17th Street Washington Dc Rv Campgrounds Near Washington Dc. Create an Account - Increase your productivity customize your experience and engage in information you care about.

The Parker County Tax Collector is responsible for. The median property tax on a 14710000 house is 245657 in Parker County. Parker County Assessors Office Services.

Parker County Primary Election results will be posted after 7pm today 312022. PARKER COUNTY PROCLAIMS MARCH 6 2022 AS BLACK BALLOON DAY. Attorneys Approved for Appointments.

Parker County collects on average 167 of a propertys assessed fair market value as property tax. The median property tax in Parker County Texas is 2461 per year for a home worth the median value of 147100. The Parker County Tax Assessor is responsible for setting property tax rates and collecting owed property tax on real estate located in Parker County.

See Property Records Deeds Owner Info Much More. These buyers bid for an interest rate on the taxes owed and the right to collect back. 1 Look Up County Property Records by Address 2 Get Owner Taxes Deeds Title.

Parker County collects on average 167 of a propertys assessed fair market value as property tax. The median property tax on a 14710000 house is 266251 in Texas. Parker County TX currently has 124 tax liens available as of March 7.

Taxable property includes land and commercial properties often referred to as real property or real estate and fixed assets owned by businesses often referred to as personal property. County tax assessor-collector offices provide most vehicle title and registration services including. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Parker County TX at tax lien auctions or online distressed asset sales.

The office of the county treasurer was established in the Texas constitution in 1846. The median property tax also known as real estate tax in Parker County is 246100 per year based on a median home value of 14710000 and a median effective property tax rate of 167 of property value. The Parker County Property Appraiser is responsible for determining the taxable value of each piece of real estate which the Tax Assessor will use to determine the owed property tax.

817 596 0077 Phone 817 613 8092Fax The Parker County Tax Assessors Office is located in Weatherford Texas. Banker for Parker County government working with departments and public for receiving and disbursing funds including general payments of county expenses payments for jury duty election workers and payroll. The Parke County Assessor is.

This applies only in the case of residential homestead and cannot exceed the lesser of the market value or the preceding years appraised value plus 10 plus the value of any improvements added since the last re-appraisal. Courthouse Annex 1112 Santa Fe Dr Weatherford TX 76086-5855 Mailing Address. Get In-Depth Property Reports Info You May Not Find On Other Sites.

Parker County has one of the highest median property taxes in the United States and is ranked 287th of the 3143 counties in order of median property taxes. Notice of Sale - Tex.

Armstrong Selected As New Parker County Chief Appraiser Local News Weatherforddemocrat Com

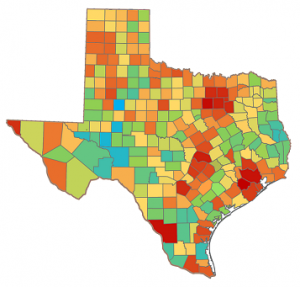

Travis County Texas Property Search And Interactive Gis Map

Parker County Emergency Services District 1 Home Facebook

Tax Assessor Chester Township Nj

Assessor Douglas County Government

Parker County Property Tax Savings

Parker County Appraisal District

Open Cama Solutions How Integration Transforms Property Tax Assessment Farragut

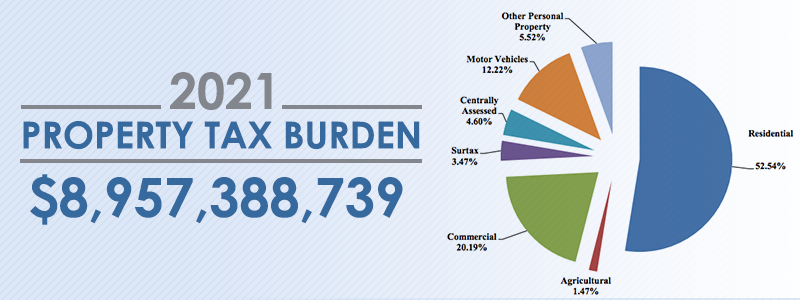

Agriculture Taxes In Texas Texas A M Agrilife Extension Service

Meals On Wheels Parker County Weatherford Volunteering

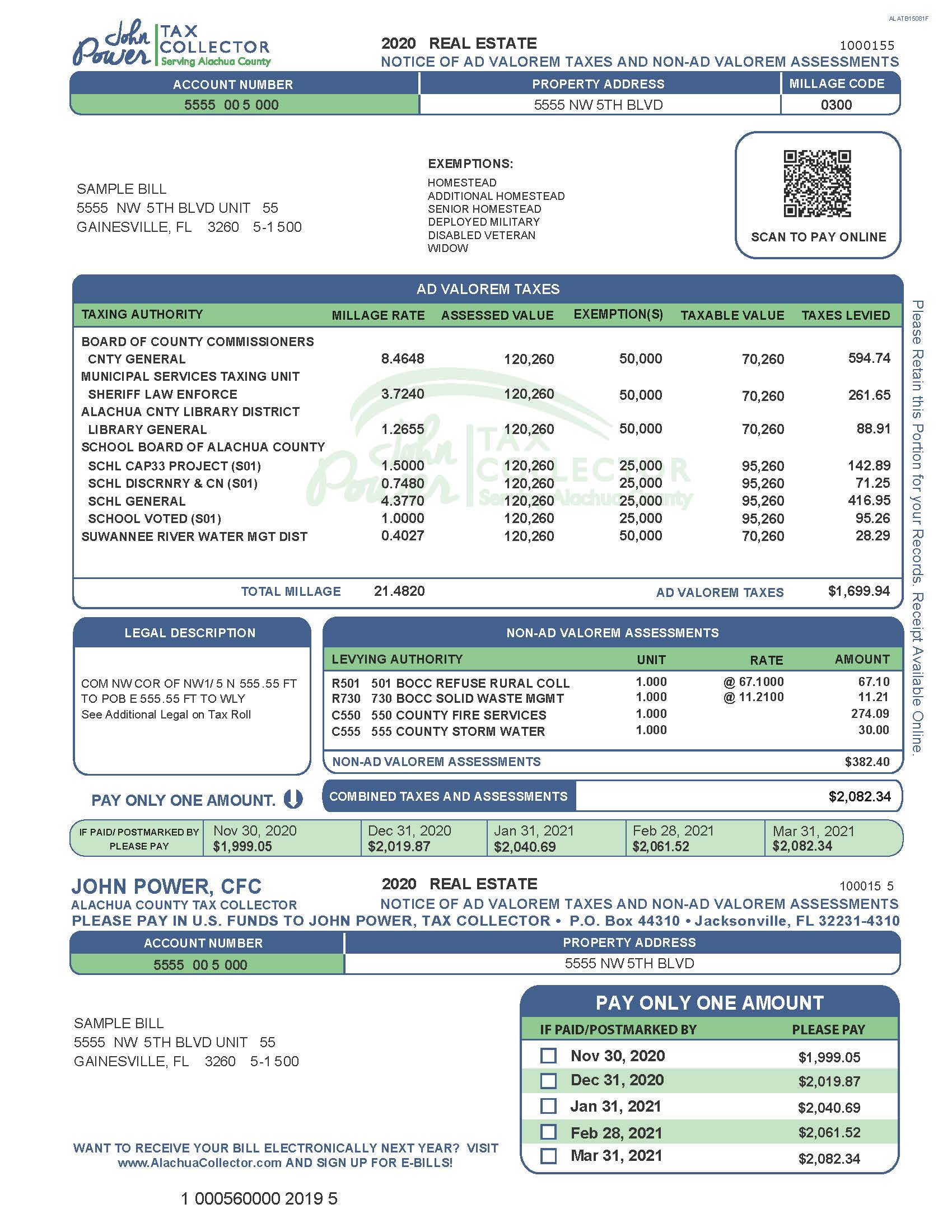

A Guide To Your Property Tax Bill Alachua County Tax Collector

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard